Uncategorized

Market Edge Advisor November 2018

- Online skills and knowledge assessments are great for understanding individual, functional and team-based capability before and after development investments.

- Unbiased work product reviews against industry benchmarks provide a multiperspective approach that identifies target performance and gaps for your business teams.

- To support the creation of a multi-year improvement plan that enables your business to achieve your strategy, make sure to map your organization’s current cultural state. Wide gaps by role, seniority, and business units can be an anchor to the past and prevent strategy progress.

Market Edge Advisor October 2018

2018 Marketing Benchmarks

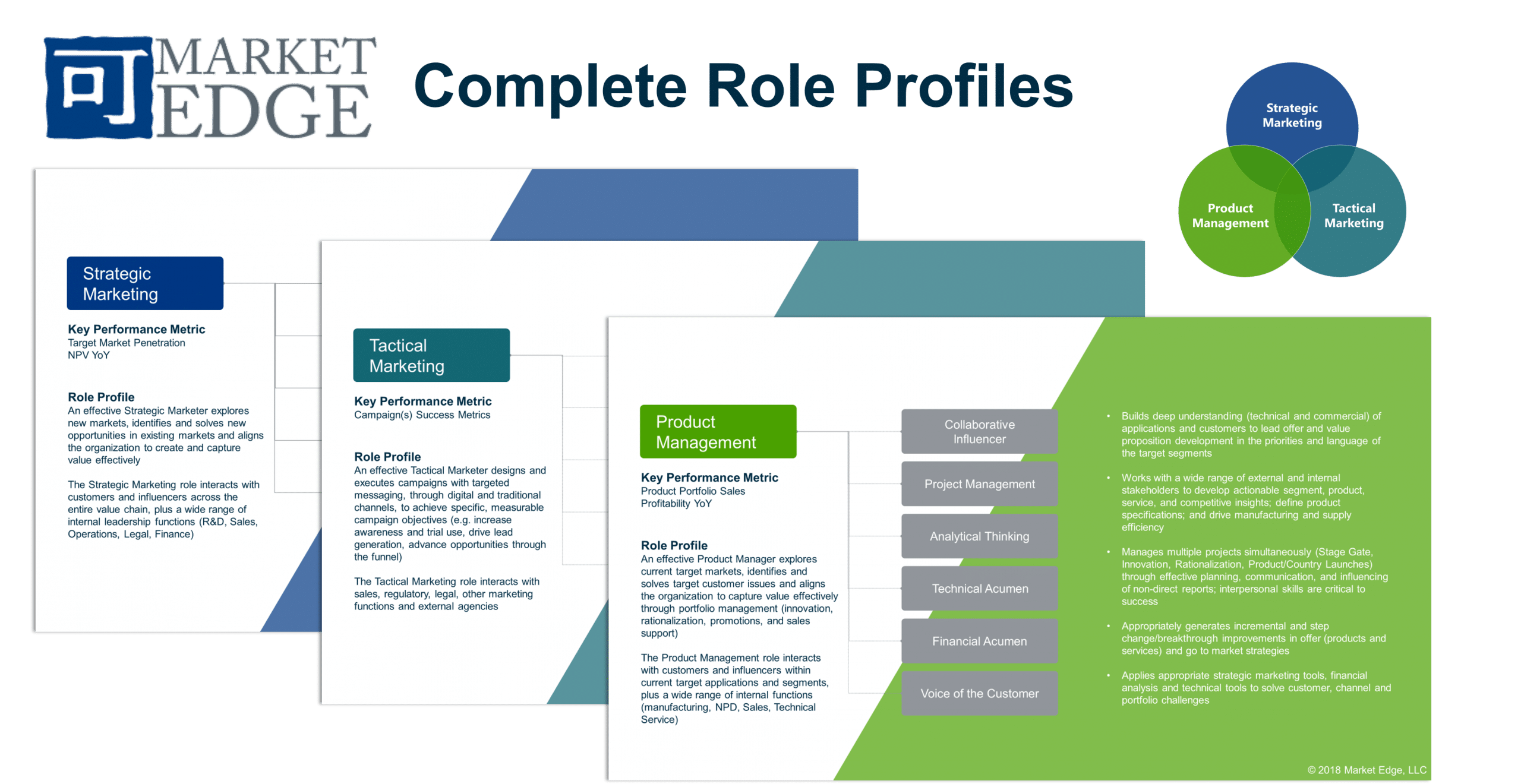

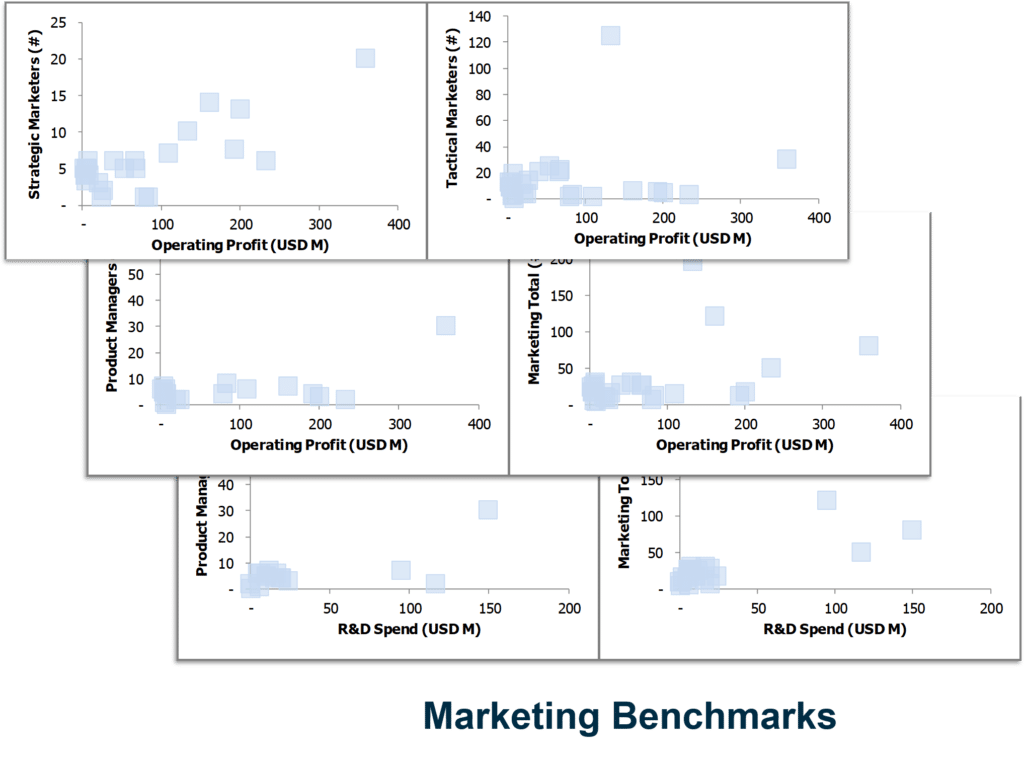

Market Edge’s proprietary Marketing Benchmarks and Capability databases are based on >20 years’ experience with category-leading clients in a range of B2B and B2C industries.

Strategic, tactical and product management marketing roles are analyzed as a function of operating profit, R&D investment and anticipated growth. Extracts from the database compare similar business units (industries, size, profitability, and growth).

Benchmarks provide guidance to determine if the quantity of marketing investment is appropriate.

Enter your Information and get a Report Fast!

Market Edge Advisor September 2018

Identifying Value-Creation Opportunities in Healthcare with the Treatment Activity Cycle Framework

When it comes to succeeding in the healthcare industry, what you don’t know will hurt you

Turning the Unknown into Competitive Advantage

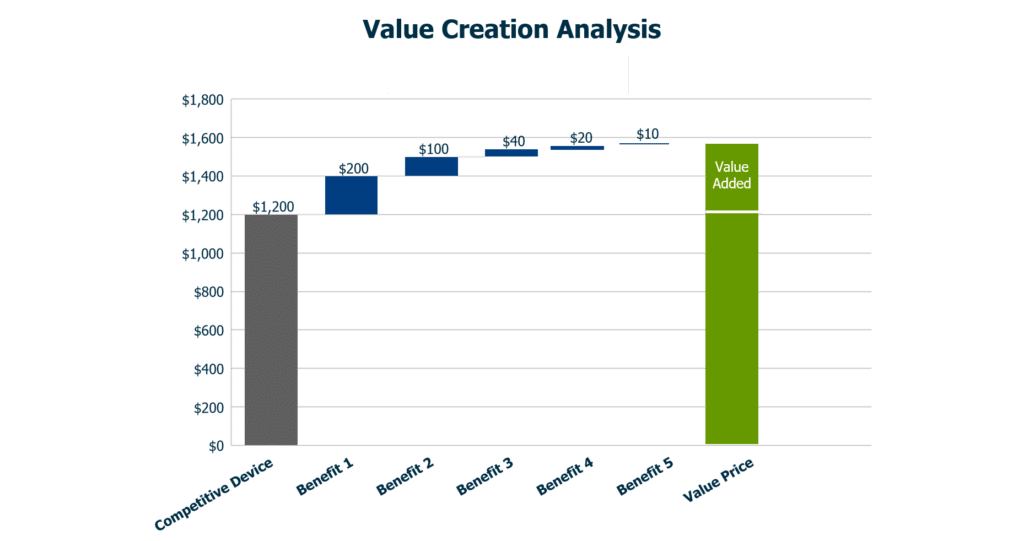

In modern healthcare, commercial success depends on designing offerings that provide value to multiple stakeholders simultaneously. Although clinical benefit is always a key factor when a patient, physician, payor, or provider evaluates a new product, it is insufficient to prompt adoption by many healthcare institutions. New medical devices and treatment options must provide significant clinical and economic value relative to the current standard of care (or next best alternative/competitor).

What is the current standard of care for your product? What demographic, regulatory, and technological trends are shaping the standard? What value can you offer to various stakeholders relative to the current standard? How will the processes and resources developed around the current standard affect the clinical and economic performance of your product? Will existing processes create barriers or incentives for adoption? How can your product streamline these processes to create more value? The complexity of the modern healthcare system provides numerous opportunities to create value; a business that is willing to invest the resources to understand it thoroughly will have a significant competitive advantage in the marketplace.

Process Mapping Reveals the Path to Customer Value

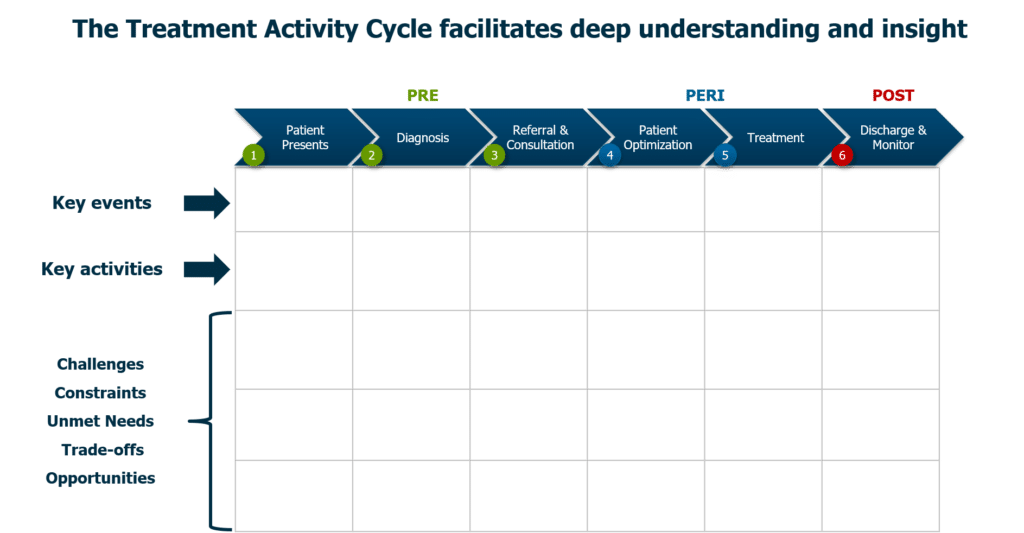

Determining the true clinical and economic value of a new product requires a comprehensive, data-driven understanding of when, where, why, and how similar products are currently used within the healthcare system. To succeed, businesses must develop this understanding early in the product development process, iteratively refine it during commercialization, and stay up-to-date on evolving standards throughout the product’s lifecycle. Research, whether primary or secondary, is necessary but insufficient to inform strategic decision-making. It is essential to articulate the treatment process through a framework like the Market Edge’s “Treatment Activity Cycle.”

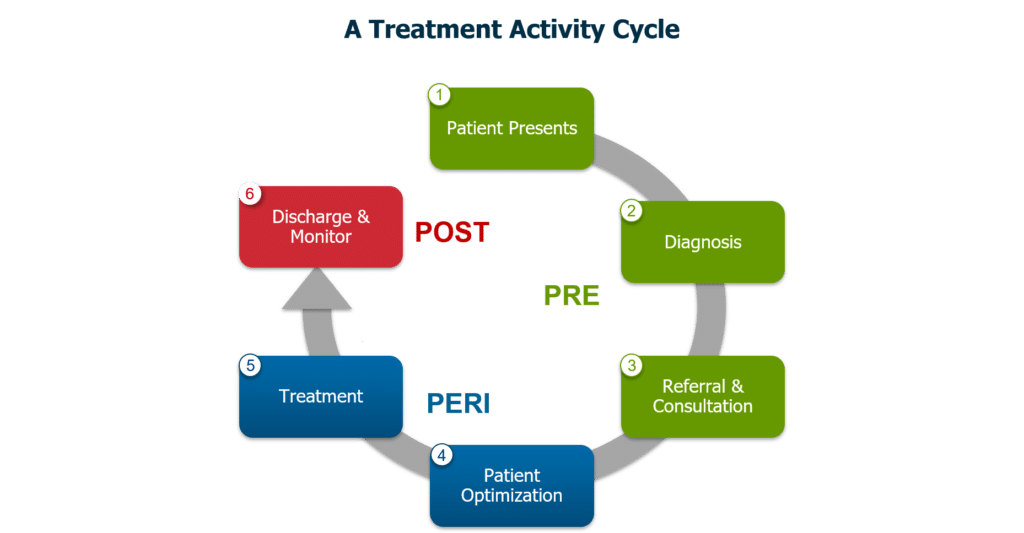

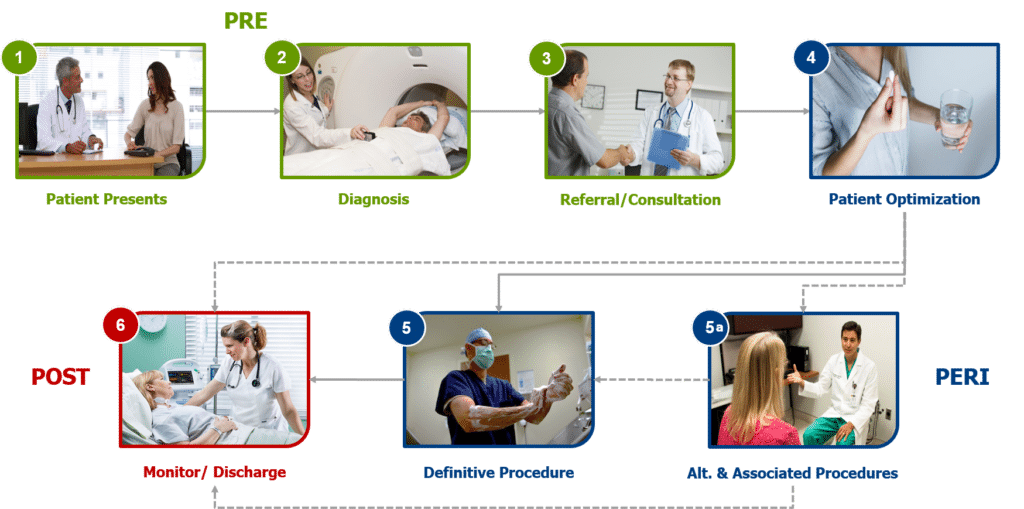

The Treatment Activity Cycle is a process mapping tool used to understand how patients move through a healthcare system and interact with healthcare professionals. A Treatment Activity Cycle focuses on patients with a particular disease or set of symptoms, tracing their path from initial interaction with a healthcare professional, through diagnosis and referral pathway, various stages or iterations of treatment, and post-treatment follow-up. A treatment activity cycle captures where, when, and how decision-making incorporates economic, organizational, and regulatory considerations.

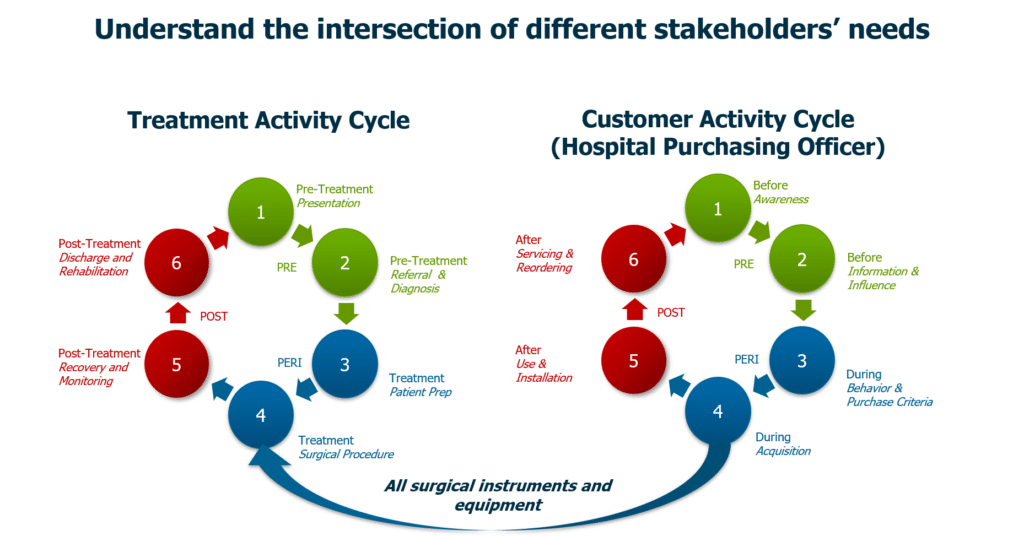

Other related business and regulatory processes can be mapped using similar frameworks, such as the Customer Activity Cycle. By utilizing consistent frameworks for different but related processes, one can clearly represent the interactions between these diverse processes and the divergent priorities of various individuals involved.

Cholecystitis: Details with Context Yield Actionable Insight

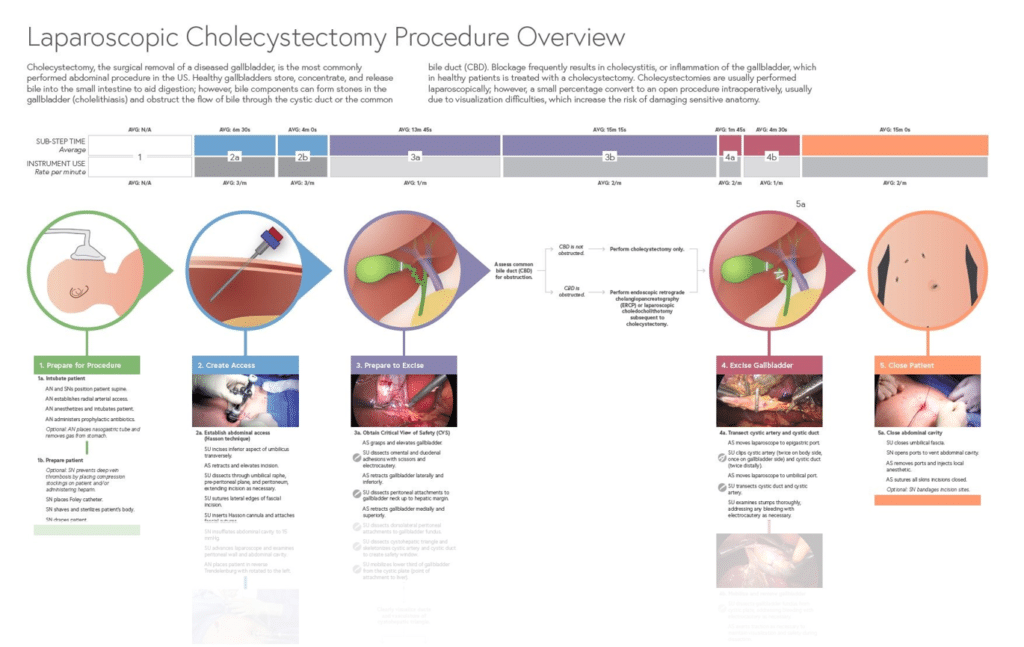

For example, consider a company with an innovative offering that could revolutionize the treatment of cholecystitis. Cholecystectomy, the surgical removal of a diseased gallbladder, is the most common form of treatment for cholecystitis, and is the commonly performed abdominal procedure in the US. In order to develop value propositions and a strategy for market entrance, it is key to understand the existing clinical pathways, including patient segmentation, referral patterns, treatment options, and reimbursement. Customer R&DSM market research techniques, such as interviews with stakeholders and direct observation of healthcare professionals, provide the data needed to understand and map this process.

Within this framework we can highlight specific strategically-relevant insights, such as the most important pain points for healthcare professionals, variations in behavior that may drive segmentation and offer positioning, and opportunities for value creation. Treatment Activity Cycles also provide a qualitative framework for contextualizing and interpreting quantitative data such as market volume, competitive share, and revenue potential.

Although it is essential to understand the treatment activity cycle as a whole, some portions may be of more interest based on a company’s offerings and expertise. The Treatment Activity Cycle framework can be applied to any component processes, at the level of detail required to answer relevant strategic questions. For instance, if the new product would be used within a cholecystectomy procedure, it would be important to understand the procedure flow, healthcare professionals involved, and surgical setting in more detail. Mapping this process would help identify opportunities for improving efficiency or providing value-added services, define key user needs, and anticipate barriers to adoption.

Regardless of the particular medical process, detailed mapping of the Treatment Activity Cycle highlights important information gaps, suggests new strategic questions to pursue, and reveals the actionable insights necessary for commercial success. It acts as your business’s working hypothesis regarding the clinical pathways and institutional mechanisms that you seek to improve, influence, or disrupt.

Every year, Market Edge teaches hundreds of business professionals how to employ the Treatment Activity Cycle framework to achieve their goals. Market Edge utilizes the framework in combination with its proprietary Customer R&DSM market research approach to provide healthcare businesses with their intelligence they need to succeed.

For more information on how Market Edge helps healthcare businesses innovate tomorrow’s life-saving treatments Click Here!

Market Edge Advisor August 2018

Characterizing the Market Landscape

How do you define the size and shape of your market?

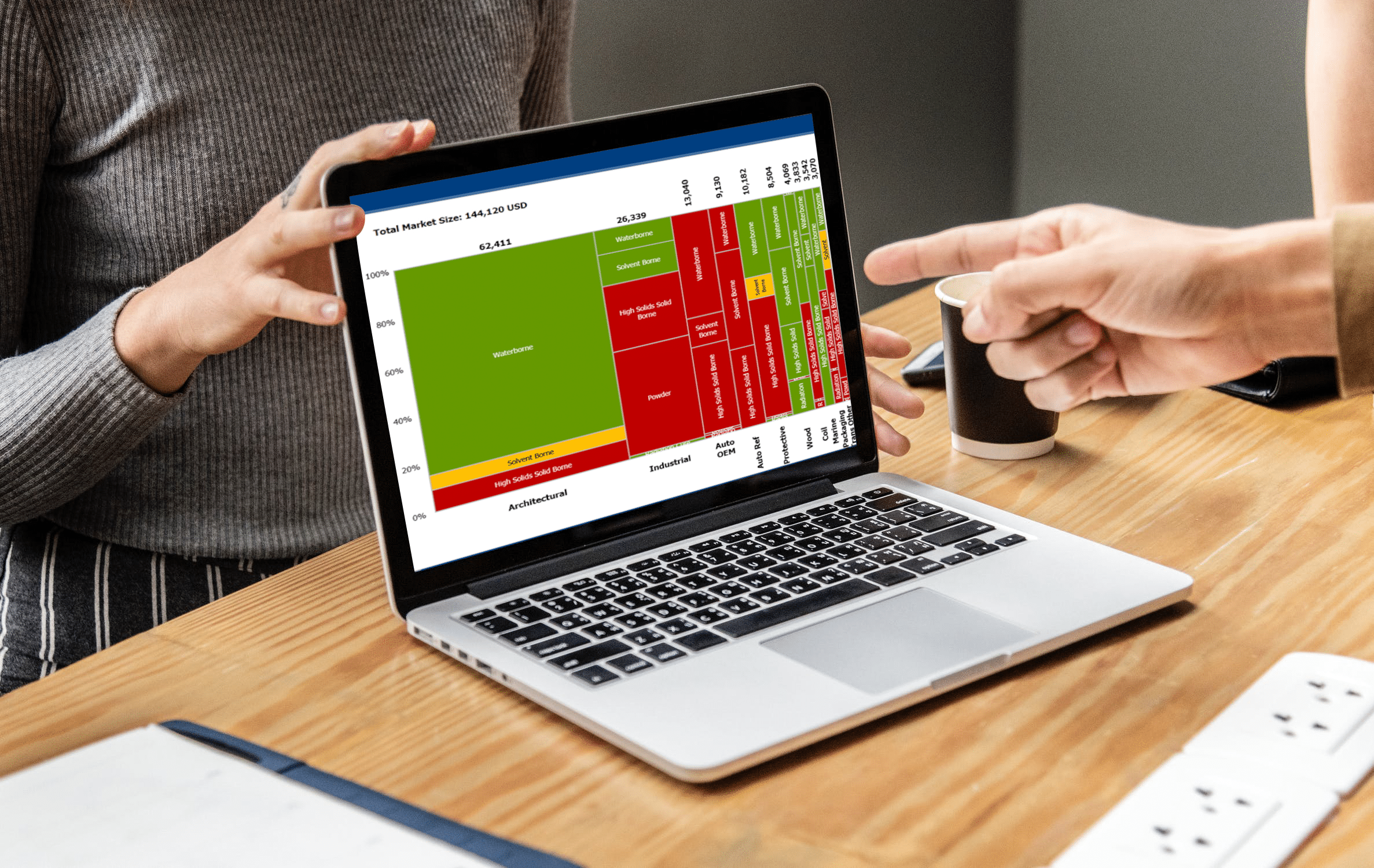

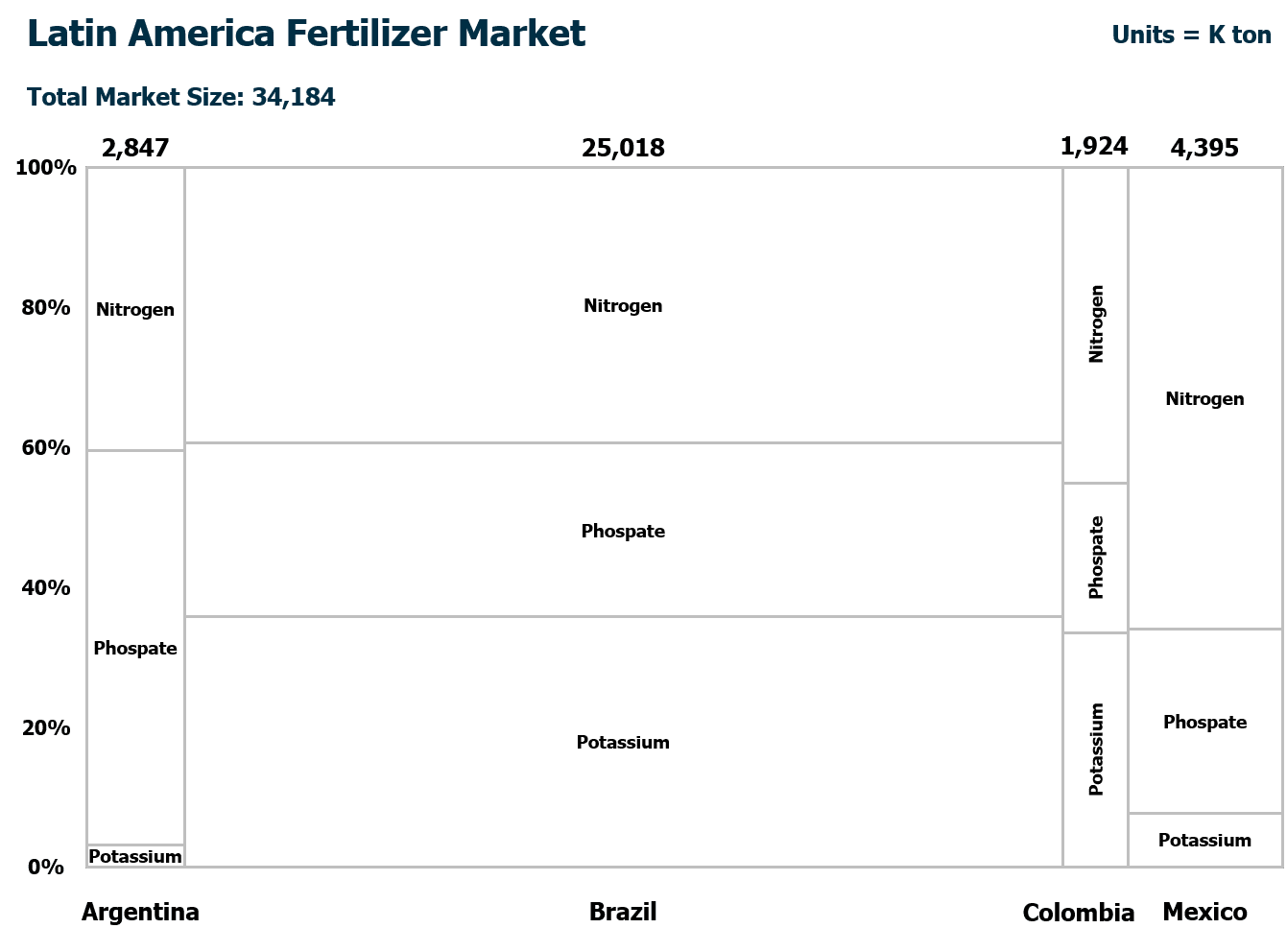

Market Landscape Maps clarify the market landscape and help businesses make critical strategy and marketing decisions. They are especially helpful to explore new markets or to compare multiple geographies.

A traditional market map shows the relative size of various sectors or market segments, applications, technologies or customers in two dimensions.

A range of criteria (dimensions) can be used to develop market maps. Creating multiple maps with different combinations of criteria generates new perspectives of the market leading to targeting and growth opportunity insights. Additional layers of information (growth rates, profitability, current areas of focus) can be added to the map to generate further insights.

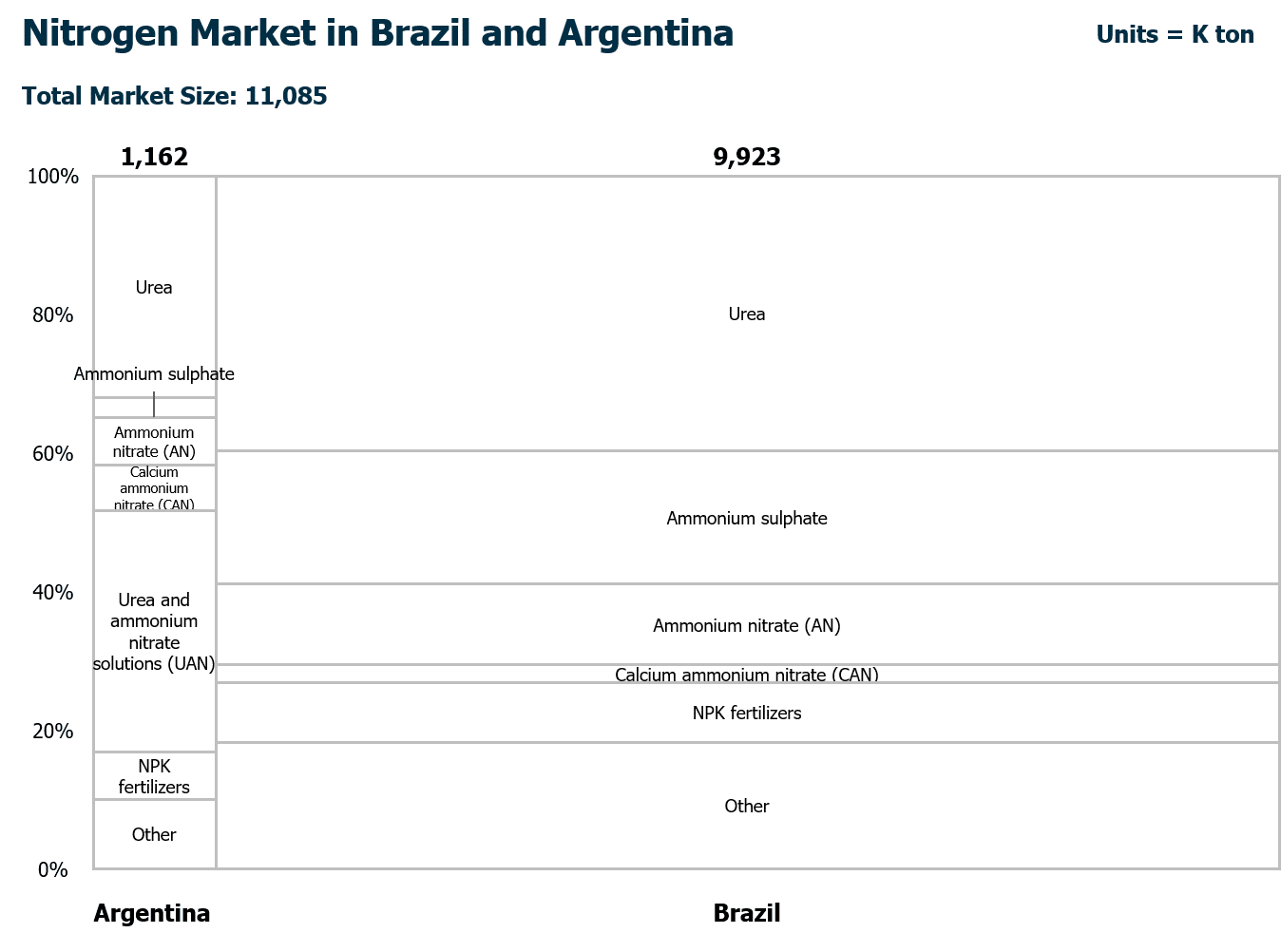

Following is an example of a Market Landscape Map we developed for a client looking for opportunities to increase their sales in the Latin American fertilizer market.

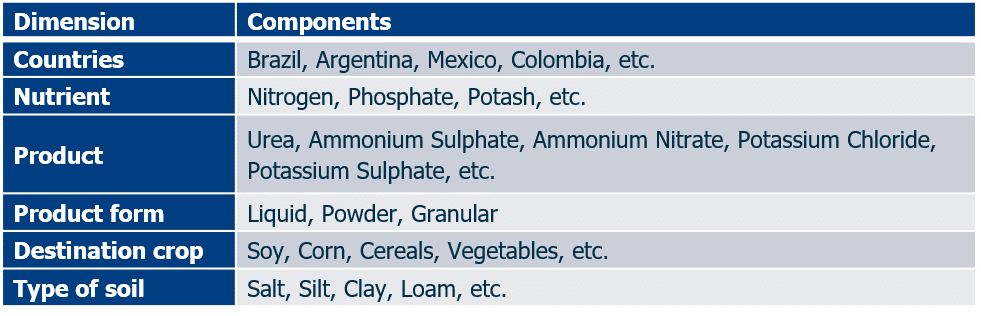

First, consider the dimensions that could be used for each axis on the map.

For an initial high-level map, the X-axis should be defined by the dimension that is driving overall market growth. Usually, this will be the applications or geographic segments that comprise the market. For the Y-axis, select the technologies or product categories that are competing to serve the market.

In our example, we developed the following map combining countries and nutrient as the initial dimensions.

Then, focusing on each nutrient, we developed multiple maps for the two largest countries that incorporated the product dimension.

Developing the Market Landscape Maps above enabled our client to identify existing gaps, improve their segmentation, develop more accurate targeting and – eventually – serve sub-segments they had not previously considered, leading to double digit top line and bottom line growth.

Market Landscape Maps are extremely useful for analyzing and communicating an overview of the target market. They help explore market adjacencies and challenge the organization to think with a market focused orientation.

For examples of the concepts and tools above in practice, contact help@mkt-edge.com

Market Edge Advisor July 2018

Use of Net Promoter Score – Is NPS the Right Tool for your Business?

Independent research on the NPS scores by industry sectors and major brands is most available for B2C companies, where word of mouth (or social media) can quickly lead to increases and decreases in sales. However, there seems to be less available independent study on B2B businesses, but that does not mean that NPS is not important to those companies as well.

In B2C environments, personal interactions more readily lend themselves to favorable/unfavorable references to other contacts (“That restaurant was wonderful – here’s a picture of my meal!”). However, in B2B environments other factors beyond just the personal interactions may come into play such as corporate procurement policies, requirements for multiple suppliers and technical performance standards that weigh equally in the buying decision process. NPS alone may not be enough to gauge potential for growth in B2B environments, so you should look deeper at other Critical Purchasing Criteria.

Utilize your knowledge of customer’s purchasing process to supplement your assessment of NPS in B2B environments. In addition to the relationships with promoters within the customer company, what are the key value drivers that will differentiate your offer from other suppliers? The combination of NPS knowledge and Critical Purchasing Criteria will help drive greater success with targeted customer accounts in the B2B environment.

Market Edge has developed simplified, online NPS assessment and Critical Purchasing Criteria (CPC) tools which can be quickly deployed to solicit customer feedback on how well you are performing and likely to be recommended to others as well as their key buying criteria. Contact us at info@mkt-edge.com (mailto:info@mkt-edge.com) to learn more about these tools and their application in your business.

For examples of the concepts and tools above in practice, contact help@mkt-edge.com

Market Edge Advisor June 2018

Do you struggle with the linkage between sales and marketing?

As businesses grow it critical maintain alignment between the sales and marketing functions. Without this alignment, impacts can be seen in:

- Account targeting – we spend our time with the wrong customers

- Value proposition delivery – we focus on attributes that are either non-differentiated from competition or our customers don’t really care about

- Value capture thru pricing – our pricing does not seem to match how value customers perceive our value

- Call planning – our sales call are ineffective or in some cases unorganized

The combination of business processes and marketing skills help organizations address the issues above and target, price and position appropriately.

Our experience with a range of global, category leading B2B companies has shown the following specific capabilities are critical to effective sales/marketing effectiveness.

- Customer Segment Targeting – we call on the “right” customers and our offer is the best fit for their needs

- Value Proposition Development and Delivery – we understand how our offer is different (and better) than competition and we deliver that message in a clear, concise and compelling fashion

- Value Capture – we price and communicate our value in a convincing fashion and capture the value that we provide

- Professional Call Planning – we plan customer calls to use time effectively (ours and our customer’s) and ensure we are continually delivering and gaining information throughout the sales process

For examples of the concepts and tools above in practice, contact help@mkt-edge.com

Market Edge Advisor May 2018

Effective Channel Management

Are you managing the channel or is the channel managing you?

In many industries the path to the market involves other companies who provide services as an extension of your company’s sales offering. In some cases these companies are true partners who reflect the same values and services that you expect from yourself. In other cases they may be actual customers who view you as only a supplier of products or services to fill out their shelves or portfolio. How is your relationship with the channel defined? Are you the influencer in the relationship or does the channel drive the ultimate sales relationship with the downstream market? Effective channel management requires a fundamental understanding of these relationships by both parties, and appropriate actions must be taken to drive the performance of channel sales.

Determining the relationship with the channel starts with an objective analysis of how products and services flow to the market and where the influence lies. Slide 3 illustrates the Market Edge approach to analyzing channels by considering how channels are selected, how they perform and the policies required to track performance.

Through a combination of market research and our proprietary analysis tools we can graphically illustrate the size and influence of potential channel partners. Once channel relationships are agreed, leading and lagging indicators should be tracked to measure the performance and corresponding actions (e.g. offers, incentives, etc.) to be taken to drive desired performance. Having a clear understanding and agreement of the influence, values and performance expectations of each partner in the relationship can lead to improved sales and performance of the channel.

For examples of the concepts and tools above in practice, contact help@mkt-edge.com

Market Edge Advisor April 2018

Are customers taking the Pricing Lever from your control?

The day you understand the value you create is the day you stop giving discounts.

Does your organization have the required commercial capabilities to raise prices?

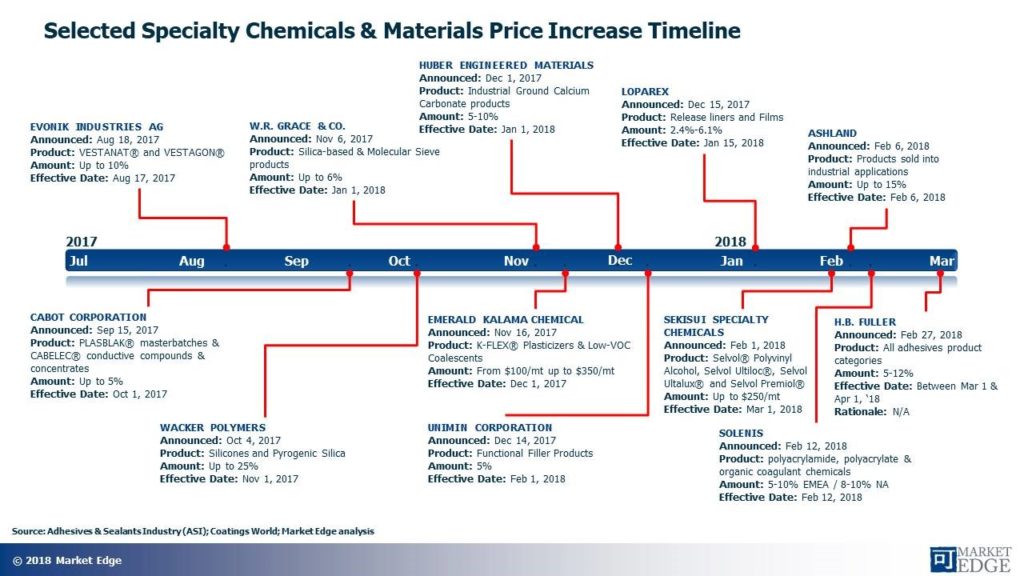

The strengthening global economy is driving the pace of price increases in the specialty chemicals and materials sector (see attached timeline of selected announcements).

However, not all businesses have the required commercial capabilities to raise and hold prices effectively.

Our experience with a range of global, category leading B2B companies has shown the following specific capabilities are critical to raising prices at the right time and retaining increased margins.

- Timing – knowing when to raise prices and leading increases from a position of strength

- Modeling – using dynamic value maps and scenario planning to model competitive response and associated impact on volume and margins

- Commercial discipline – implementing price increases clearly while minimizing exceptions and backsliding

- Price performance management – rigorous post increase analysis to ensure margin, volume and working capital effects are delivering the targeted increase in cash flow