If you are responsible for sales and marketing performance, here are 4 specific actions you should complete to start the year.

Uncategorized

2020 Business Success Starts Now!

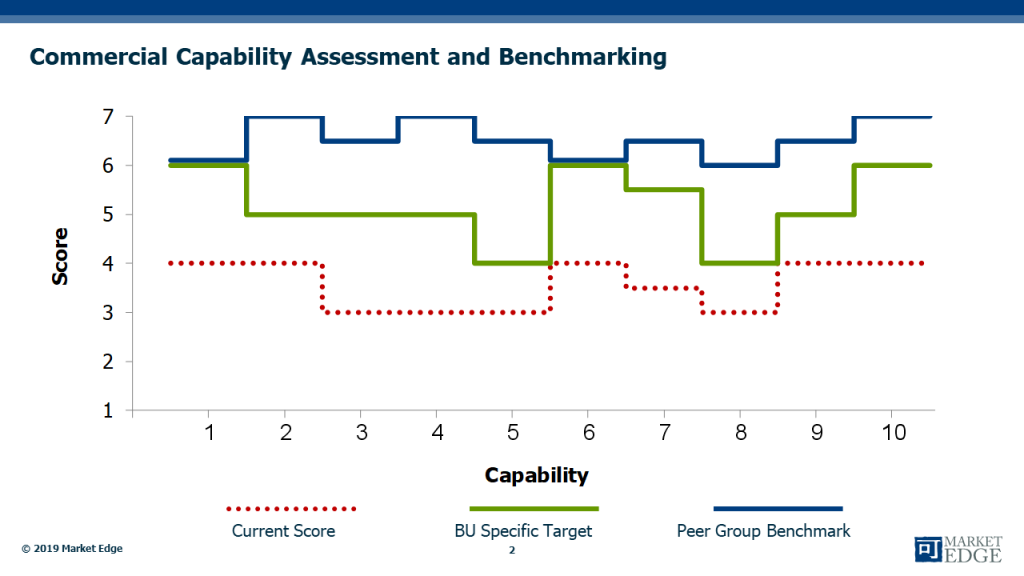

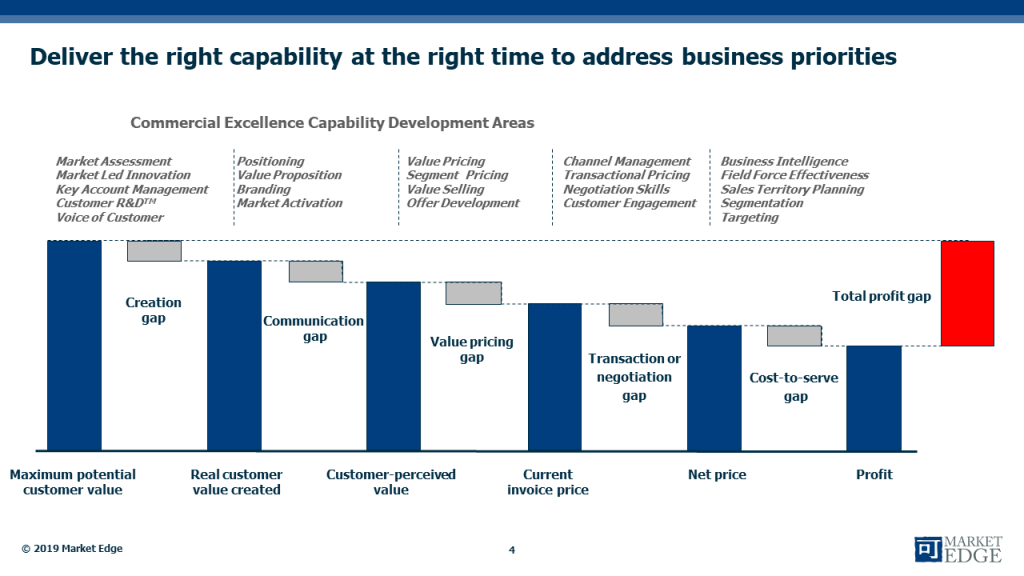

1) Assess your organization’s commercial capabilities and identify priority gaps critical to delivering your 2020 business plan. Best-practice develops the right capability at the right time to address business performance priorities. For example, if a business unit is launching several new products, campaign design (marketing) and campaign execution (sales) are important capabilities and associated gaps to current capability should be a priority. Market Edge has Sales and Marketing Capability Assessments for individuals and business units that can be compared to a database of B2B companies with similar characteristics.

“Do we have the right commercial capability to deliver our strategy and maximize profit?”

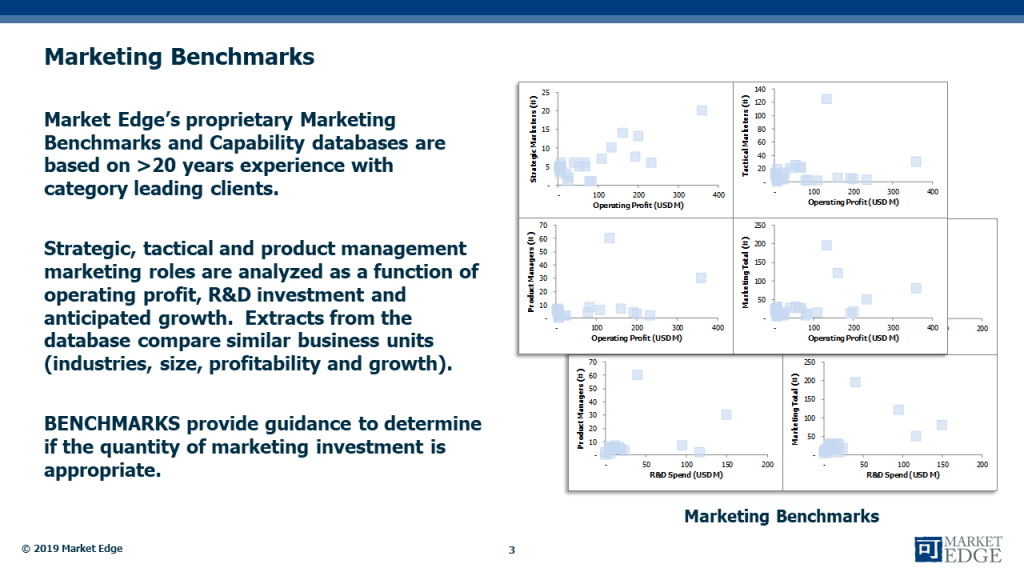

2) Fight for Budget and Calendar space now! Have you optimized your organization’s level of strategic marketing, product management and marketing communications resource? Market Edge Benchmarks compare resource allocation by role for similar business units based on size, growth, profit and R&D investment. Once you have the necessary resource in each role, develop the right capability at the right time. Schedule 2020 development priorities so that capability comes on line ‘just in time’. For example, if the business’s most important campaign is in Q3, schedule training in Q2 that delivers applied learning to the coming campaign.

Lead the discussion in your business unit, “Are we investing in the right resources and scheduling our priorities?”

3) Identify priority campaigns and begin campaign planning NOW! Have you agreed the most important campaigns that will make 2020 a commercial success? Campaign design starts with a verb and clear target segment (e.g. launch our new technology in the innovator segment; re-enter the mass market; raise prices in the conservative segment). Do you understand the segment specific ‘moments of truth’ and touchpoints that will make the campaign effective? If not, market research may be necessary before campaign design.

The campaign’s overall objective should be cascaded to a combination of leading and lagging indicators. Consider teaser campaigns or other proactive market activation tactics to build awareness, engagement and anticipation before the heart of the campaign.

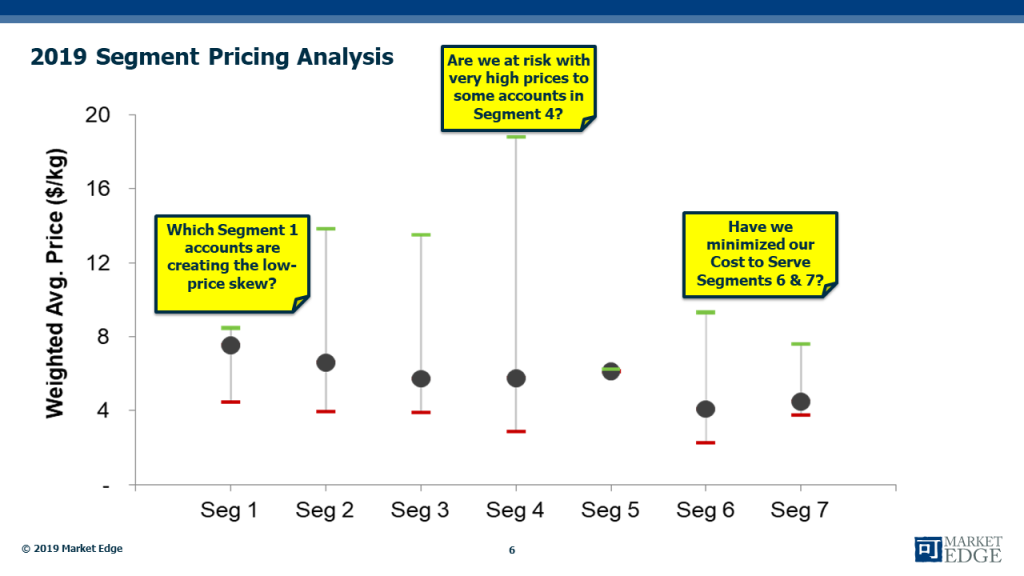

4) Update segmentation and targeting to provide guidance to sales so they are focused appropriately in 2020.

Segments are groups of customers that think and behave differently so it is likely that they will have achieved different business results in 2019. Update segment analytics as the year comes to an end. Has the size, growth rate, average margin or retention rates for your segments changed?

Provide Sales fresh targeting and marketing mix guidance to start the new year, paying special attention to segment specific pricing policy (e.g. never discount segment X, price to maintain share in segment Y). Targeting and margin improvements enacted now will provide improved performance throughout the entire year.

Interested in a conversation about campaign planning tools and B2B marketing best practice examples? Contact info@mkt-edge.com.

Are there industry shifts that require updates to your Value Chain?

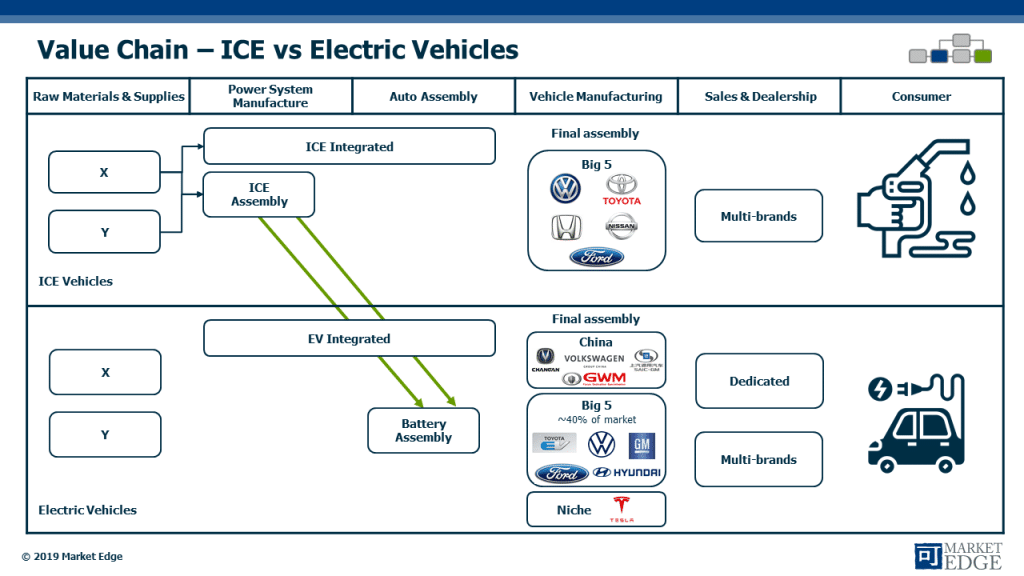

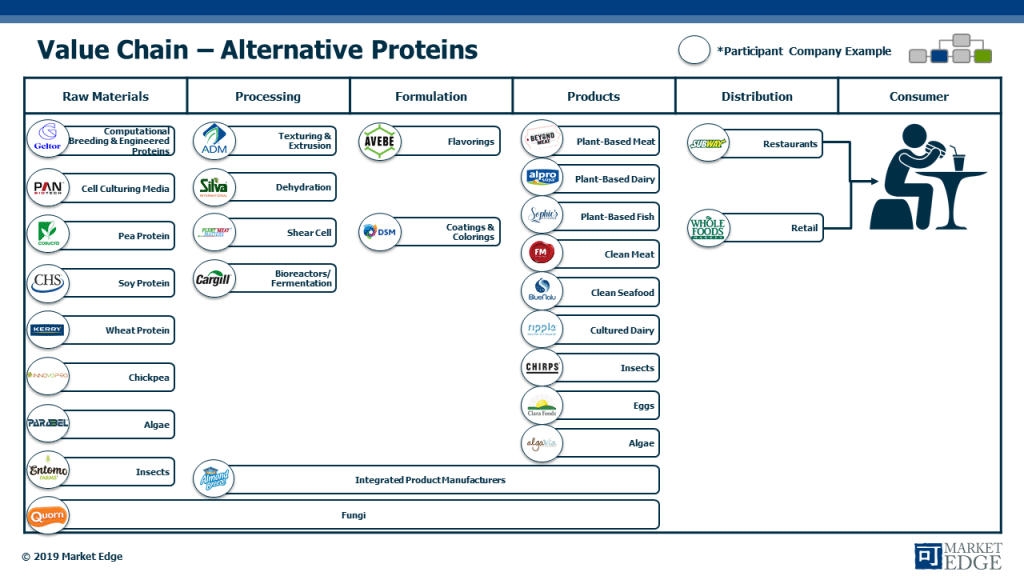

When you analyze PEST (Political-Economic-Sociological-Technological) drivers in B2B markets, like the growth of Electric Vehicles (EV) in the automotive market or alternative proteins in food, what are the implications for the Value Chain and how products are brought to market?

In the automotive industry, EVs are moving from the early adoption to the growth phase. The Value Chain steps associated with vehicle assembly are significantly changing as internal combustion engine (ICE) assembly is replaced by battery assembly and installation. If you are a traditional supplier to ICE powered cars, how will this affect your operations (materially, geographically, labor, etc.)? Some of this change is already playing out in the current GM labor dispute, where manufacturing operations are being moved to vehicle assembly locations (where battery installation occurs) versus engine assembly. How will this shift fuel distribution and adjacent services in the future?

In the case of alternative protein development and adoption, how does the growth in plant-based or cellular-based proteins alter the Value Chain? If you are a supplier to traditional meat processing operations, how will the shift to extruded plant proteins and lab-grown cellular proteins affect the strategic direction of your business?

The Value Chain is the backbone of B2B business system analysis and defines how value is created and transferred in a particular market. Raw materials are sourced from a number of plant protein producers or cellular protein manufacturers, processed and formulated into the form and features consumers desire, then distributed through retail to consumers, flowing left to right. Depending on population growth and demand trends, significant shifts in protein production away from animal protein may be seen and affect (geographically) where proteins are produced.

Value Chain analysis is the basis for other strategic marketing analyses, such as Porter’s Five Forces and Opportunities and Threats. Often during strategy development, options to reconfigure the Value Chain emerge (e.g. “let’s eliminate distribution and go direct to consumers…”. Before starting on potentially rewarding but very risky strategies that redesign the Value Chain, be sure to develop a thorough understanding of how of the Value Chain is currently structured and the forces that are driving performance and change. If you are seeing significant shifts (e.g. regulatory changes or threat of new entrants), it may be time to reevaluate the Value Chain and the implications for your business.

Segmentation: What does a Gecko have in common with dating Apps?

Understanding customers creates opportunities from communication today to innovation for tomorrow

“Save 15% or more”

“So easy a caveman can do it”

“Happier than a camel on hump day”

Each of the above has a clear and simple position that conveys a benefit (savings, ease of use, satisfaction) and speaks to a target segment. For Geico, these three positions, and many more, lead customers to one product. That’s correct, one product promoted/ positioned differently to address “needs based” segments within a market. Segmentation supports unique communications and product positions that “speak to a target customer in a way that resonates.”

What does this have to do with dating apps? Spark networks is using the same common principles when addressing the dating market. Spark combines promotion with some product adjustment to offer largely the same product to multiple “demographic” segments.

Using a car analogy, for Sparks, the “engine” is the same, but the promotion and the “paint job” are designed for the target segments – and they are not alone.

Match Group markets the following products using a different segmentation scheme to address the same broad dating market.

In each of these examples, customer understanding leads to segments that are addressed differently. In a B2B environment these same principles apply. Develop in depth customer insight and use that insight for communication, offer development, innovation or any of the myriad of activities in between.

In today’s B2B markets, you may be faced with similar “engines” that are being marketed by competition. Deep customer insight that leads to actionable segmentation can make all the difference.

For examples of the concepts and tools above in practice, contact info@mkt-edge.com