NPV in MLB

How Could the Philadelphia Phillies Give Bryce Harper a $330M Contract?

by Dave Anshen, Sr. Consultant, Market Edge

Image from USA Today

As we approach the start of the 2019 baseball season, baseball fans and analysts are debating the decisions by the California Angels and Philadelphia Phillies to give such lucrative contracts to Mike Trout and Bryce Harper respectively. Just a few weeks ago, Bryce Harper received an unprecedented $330 Million (13 year) contract. Until Mike Trout’s deal with the Angels, Harper’s deal was the largest contract in the history of the big four U.S. professional sports (MLB, NHL, NFL and even the NBA). While some observers might want to believe that these deals are based upon emotions, these contracts are purely financial decisions. For example, if we take a deeper look at the Phillies’ deal with Harper, the financial analysis looks very attractive.

Whether it’s a Fortune 500 company, private enterprise or professional sports, business decisions must consider both strategic and financial metrics. In the case of the Philadelphia Phillies, a Net Present Value analysis is all that is needed.

The NPV Analysis

It is now public knowledge that Bryce Harper had several non-negotiable items, and a 13-year contract was at the top of his list.

As the Phillies considered various scenarios, they also needed to assess their risks and key assumptions that should be incorporated into their analysis. This type of discussion is similar to a company decision to enter into a new business venture, or develop a new product. Bryce Harper is the new business venture and there are potential risks to be considered. Also, there are minimum, likely, and optimistic scenarios regarding revenue streams. In the corporate world, this would be primarily driven by market size, market share, and the selling price of a product / service. In the case of professional sports, it is primarily driven by stadium attendance and TV revenue. Other revenue contributors include parking fees, apparel licensing and stadium concessions.

The biggest factor is the assumption that signing Bryce Harper will increase the attendance at the Phillies home stadium. Just considering the regular season, there are 81 home games. If the Phillies make the playoffs (beyond the wild card game), there could be an additional 4-12 home games each season. Based upon historical data, the Phillies attendance increased by more than 500,000 per (regular) season in years when they made the playoffs.

Key Assumptions:

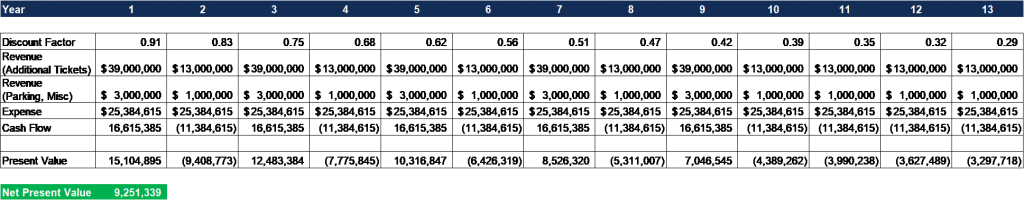

- For the Net Present Value analysis, we will assume they will make the playoffs in year 1, 3, 5, 7 and 9 (only 5 out of the 13 years of his contract).

- During these playoff years, there will be additional TV revenue and attendance revenue as well.

- Ticket prices have weighted average of $65 each.

- 50% of the attendees will park at the stadium (with an average of three persons per vehicle).

- No additional apparel revenue is included in this assumption (this will be considered upside). Note: there are already reports that apparel sales are increasing significantly

- No additional TV revenue is included in the model – because that information is not easily available, but certainly can be estimated by the Phillies management team

- Bryce Harper will be injured 3 years (of the 13) and this is reflected in assumption #1

NPV Equation:

In this equation:

Rt = net cash inflow-outflows during a single period t

i = discount rate or return that could be earned in alternative investments

t = number of time periods

As a simplified scenario, let’s consider the following:

T = The number of time periods = 13 (years)

i = 10% (or .10); This is a reasonable assumption for the current market environment

The net cash flows over the 13 years is estimated as follows:

Based upon the assumptions, the Net Present Value is a positive $9,251,339.

This does not even include any incremental TV revenue or apparel licensing revenue. So, even with these (arguably) conservative estimates, it seems to be a sound business and financial decision for the Phillies.

In summary, all significant business decisions need to consider both strategic and financial implications. In this case, an unbelievably large (and unprecedented) contract appears to be a sound financial decision – even on a risk adjusted basis. When you have financial discussions in your company, it’s absolutely critical that you identify potential risks and assumptions, and agree upon the key assumptions that will have the largest impact on the NPV analysis. In situations where you have many scenarios and probability factors associated with each assumption, you may need to consider more advanced analytical tools (e.g. Crystal Ball®). The Market Edge team helps clients with strategic decision making and the qualitative and quantitative assumptions that help guide sound decisions.