Has 2020 Shaken Confidence in your Strategy?

Before investing limited management resources in an initiative to develop new strategy, use scenario planning to pressure test your existing strategy.

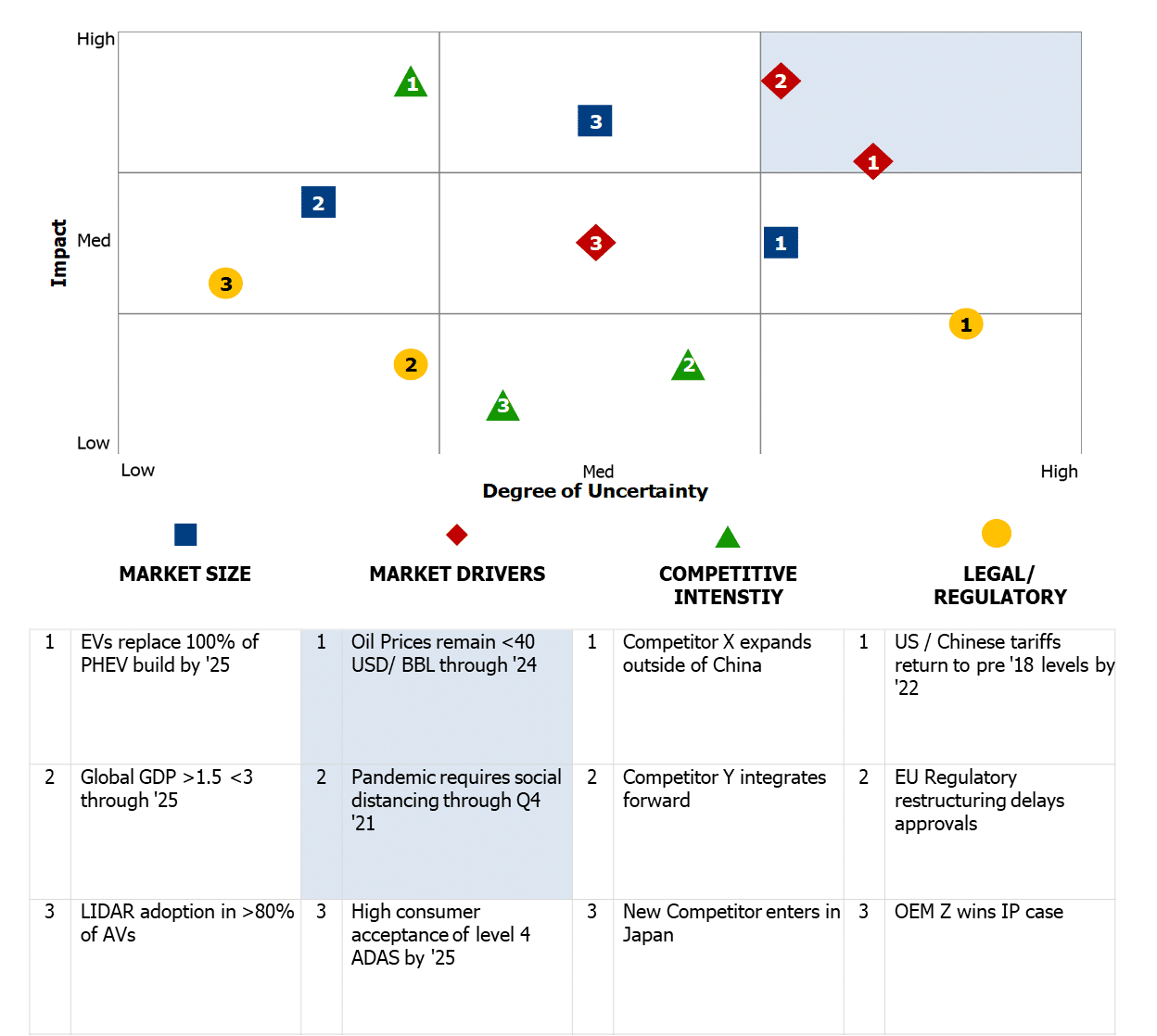

In January, if you forecasted the collapse of oil prices, a global pandemic and extensive civil unrest, you don’t need this month’s Advisor. For the rest of us, revisit your strategy, assessing market drivers and assumptions for impact and relative uncertainty. Typically, this is done via an Uncertainty Assessment like the following, redacted example which includes a careful review of implicit assumptions.

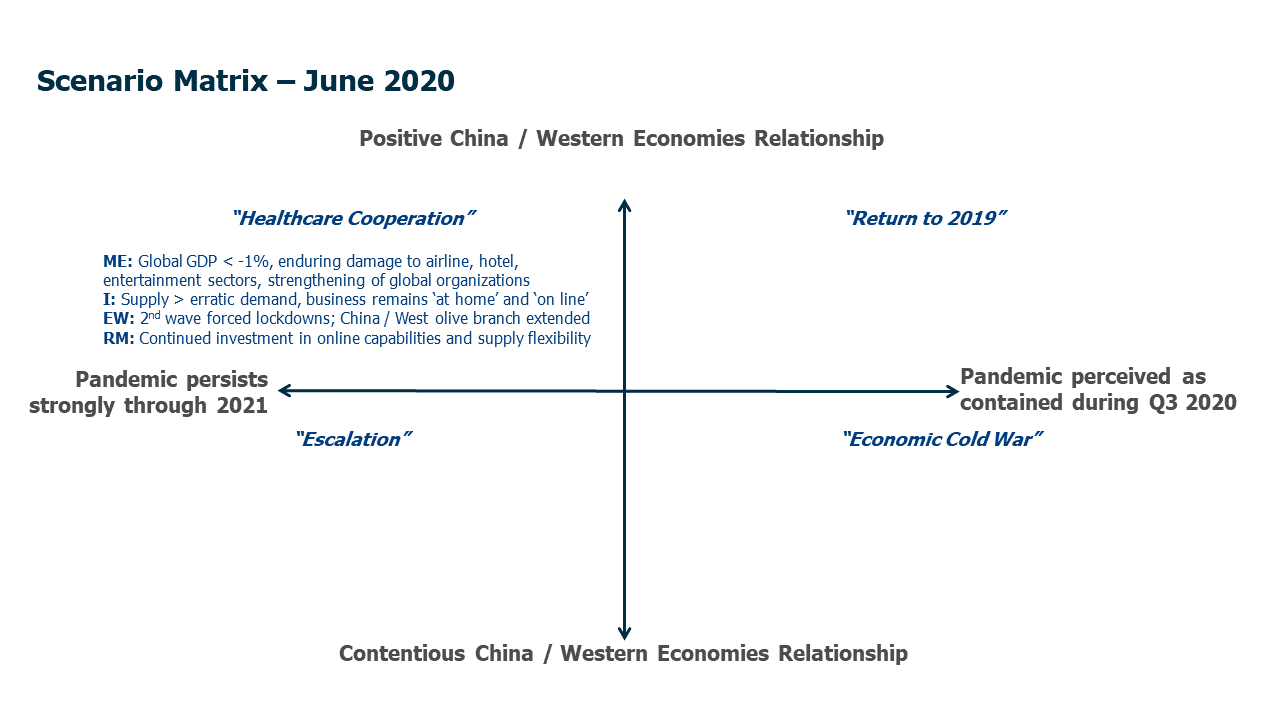

Next, develop scenario plots for combinations of the high impact / high uncertainty drivers.

Assess each scenario driver’s ‘extremes’ in both directions. For example, if oil price is a driver for your business, the lower extreme could be that there is <10% chance that oil remains below 40 USD / Bbl through 2024. The upper extreme could be that there is <10% chance that oil increases above 85 USD / Bbl by the end of 2024.

Considering the four scenarios that are generated when combining two drivers at their lower and upper extremes.

For each scenario plot (quadrant), indicate:

Market Environment – describe likely market conditions in that scenario

Implications – suggest the effect on your market and business

Early Warnings – identify possible first signals that the driver is moving toward the extremes

Risk Management – agree contingency planning, insurance, financial hedging and other tactics to mitigate the risk now

Upside – brainstorm opportunities to thrive in this scenario

For most businesses, the length and severity of the pandemic is an obvious scenario driver. Increasingly, for many of our clients, deteriorating relations between China and Western governments is becoming a critical scenario driver.