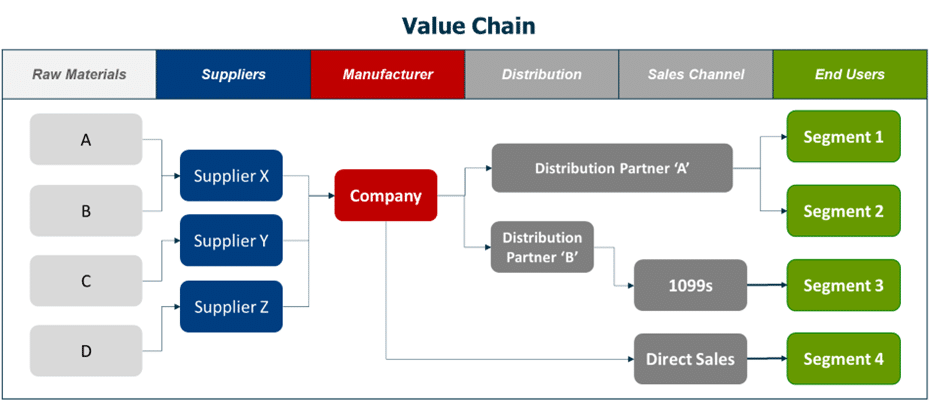

If your company sells its products through distribution partner(s), understanding the end customer remains critical to long-term success. While the distributor typically manages the direct relationship, the manufacturer or supplier must still grasp who ultimately uses the product, what problems it solves, and what value it delivers to the end user. Without this insight, it becomes difficult to design and innovate products that truly meet the needs of the people who matter most—the end users. Furthermore, if you don’t understand the value in use, it is impossible to price your product or service based upon value.

Value Chain: The missing insight

Relying solely on a distributor’s feedback can create blind spots (Segments 1, 2, & 3) compared to Segment 4 via your direct sales team. Distributors often focus on inventory and sales volume rather than detailed user experience or evolving customer preferences. By independently gathering insights through market research, social listening, or end-user engagement programs, companies can spot trends early, identify pain points, and make strategic decisions that strengthen their brand and competitive advantage.

Ultimately, understanding the end customer empowers both the manufacturer and the distributor. When you can tailor your offer, messaging, and support based on genuine user insight, the distributor also benefits from higher sales and customer satisfaction (e.g., NPS®). This shared understanding fosters stronger partnerships, better product-market fit, and sustainable growth across the entire value chain.

Here are three questions to help you assess if your business has potential blind spots in understanding your end customer:

- “Do we rely solely on our distributor for customer insights, or do we have direct ‘channels’ – such as voice of customer, surveys, user feedback, and/or field visits – to understand how our products are actually used?”. This question helps assess whether your company has an independent, firsthand view of the end customer experience.

- “When was the last time we updated our understanding of the end customer’s needs (i.e., Critical Purchase Criteria), pain points, and decision-making criteria?”. Customer behaviors and priorities evolve quickly; this question surfaces whether your company’s assumptions are outdated.

- “Are product development and marketing decisions guided by end-user insights, or primarily by distributor feedback and sales data?”. This question reveals whether decisions are truly customer-centric or potentially biased (i.e., filtered through a distributor’s interests).