Business leaders face internal and external challenges when deciding the “right time” and “right price” to divest. Continue reading to learn how Market Edge helped a client in the Building and Construction industry turn a divestment scenario into a growth opportunity.

The Strategic Choice

A leading Building & Construction Chemicals business was fighting to survive in North America, their primary market. Although they were a key player in this 1.4 B USD market, they lacked the scale that would allow them to compete profitably against their main competitor (Global Leader). The company was 100% focused on developing and implementing a strategy to revitalize its future in North America by reducing cost, increasing production efficiency, and building long-term supply agreements with customers. However, with limited resources, the required focus meant that future growth opportunities outside of the US and Canada would not be resourced.

The Approach

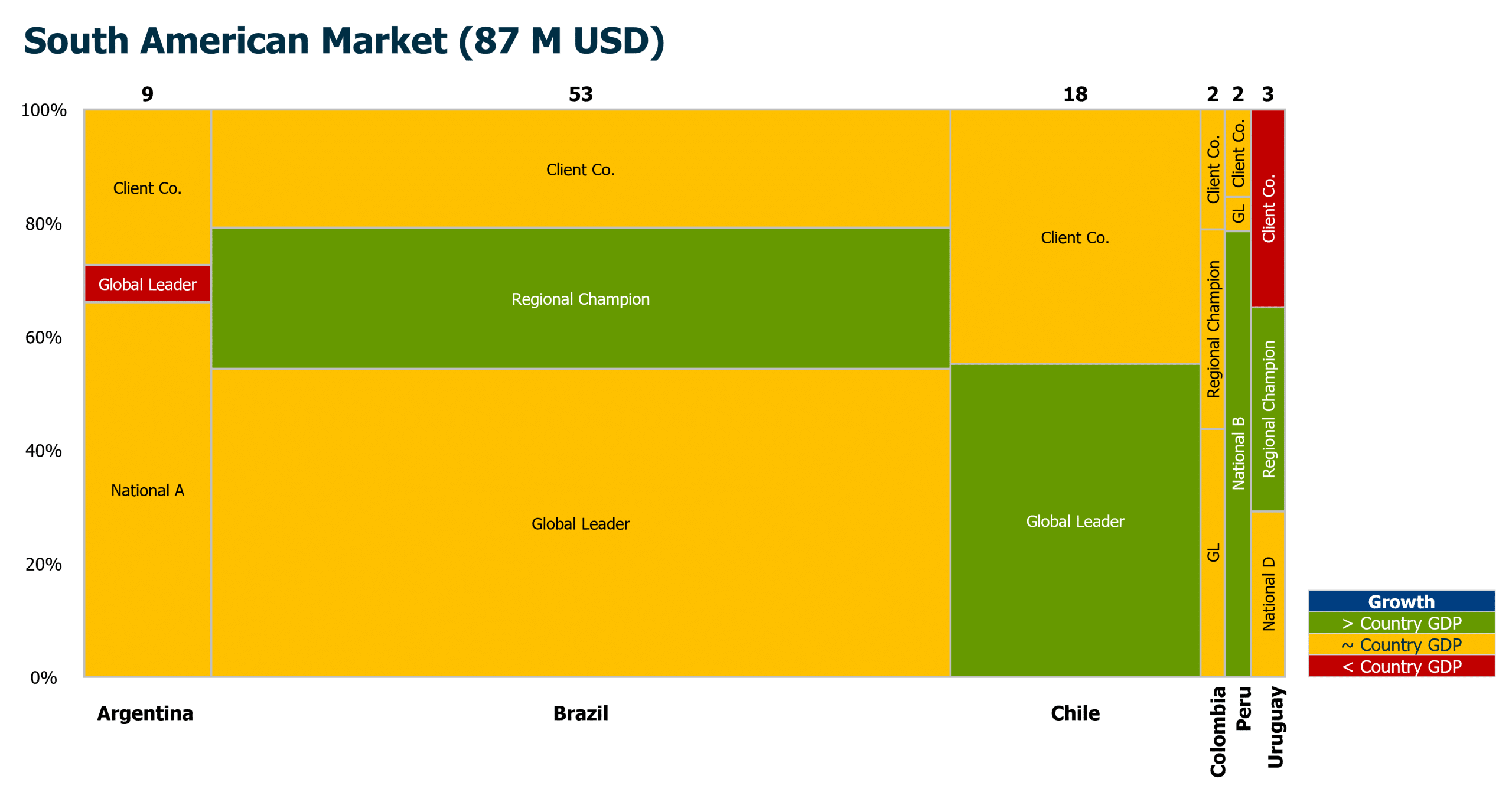

South America was a static, low-value, price-sensitive market, with one local player dominating the market (Regional Champion). The business had historically been losing money, and resources invested in this market would only dilute earnings and distract the company from the fundamental focus in North America. A decision was made to exit the South American market to improve the global P&L and allow more management focus on the critical North American market.

- The Role of Market Edge

The company engaged Market Edge to evaluate the business, prepare the divestment/exit case and write a presentation for gaining the approval from their Board.

- The Process

-

- Evaluate the market and competitors

- Propose a range of exit strategies

- Model the financial impact and risk of each strategic option

- Write the management proposal

The first step was to ensure that the market was properly quantified. To do this, Market Edge…

-

- Analyzed import statistics for raw materials and finished products

- Calculated local production capacities

- Examined the competitors’ financial filings

- Reviewed product registrations

The work revealed that the Regional Champion no longer dominated the market. Instead, they had been replaced by the Global Leader, the same competitor causing the client significant pain in North America.

Unlike the client, the Global Leader did not have local production in South America and relied on a third party for manufacture. This created a new strategic challenge as the client could not afford for their main competitor to gain even more global scale advantages when buying raw materials. It also highlighted a lack of market knowledge, begging the question: “How can a competitor afford to pay a third party to manufacture and still make a profit?”

The Rescoped Project Focus

Market Edge reviewed production capacity and costs, identifying opportunities to increase output without increasing total fixed costs. Next, pricing strategy was reviewed with the local sales team to analyze market elasticity and model pricing moves that would win incremental volumes with fixed-term contracts, a new approach for this industry.

Strategic marketing and financial analysis identified:

-

- A step change in understanding of the market and competitors

- An immediate 10 M USD growth opportunity driven by volume

- Funding for additional sales resources required to support growth

- Improved operating profit resulting from production efficiencies delivered by the additional volumes

The Outcome

The client was able to maintain their focus in North America and has implemented a strategy that is successfully redressing the imbalance of that market. Market Edge’s insight and proposal for South America have been implemented, resulting in an increased market share within three months and a sustainable P&L for the future.

For more information on how Market Edge can assist with Strategic Marketing Capability, contact us using the form below.