Continued price increases on popular products from global companies has resulted in “shrinkflation” talk and frustrated shoppers. Lingering supply chain issues that peaked during the pandemic, and lasted a few years post-pandemic, meant that there were higher costs for everything from transportation to ingredients. In response to higher costs, many global companies have significantly raised prices, resulting in shoppers either forgoing some of their favorite products or eating the price increase.

Navigating Price Hikes: Lessons from the Carrefour-PepsiCo Dispute for Key Account Managers

Carrefour, one of the world’s largest supermarket chains, operates thousands of stores in over 30 countries. In conjunction with the French government, Carrefour tried to force global retailers and food manufacturers to bring down prices. While PepsiCo continues to grapple with its own cost increases to try and maintain profitability, Carrefour attempted to hold prices down for its customers and protect its bottom line.

Their three-month long dispute recently ended, but this example of increased friction between Consumer Packaged Goods (CPG) companies and their retail channels shows how these steps in the value chain are interdependent. “When retailers pull brands as a negotiation tactic, it hurts their relationship with suppliers and makes brands less willing to spend on their advertising services…” and it “makes advertising budgets an ace up the sleeve of consumer goods giants in price talks” said Laurent Thoumine, Accenture’s Europe lead for retail.

Reid, Helen, and Richa Naidu. “Carrefour Pulls Pepsico Products over Price Hikes | Reuters.” Carrefour-Pepsico Dispute Sheds Light on Key Role of Retailers’ Ad Business, Reuters , 4 Apr. 2024, www.reuters.com/markets/us/carrefour-says-it-will-not-sell-pepsico-goods-due-price-hikes-2024-01-04/.

When setting Pricing Strategy, there are 4 elements that should be considered:

- The value of your offer (as perceived by the customer)

- The competition and the price of their offer

- The costs that you incur to provide the offer

- The macro environment and its impact on the value chain associated with the industry

Inflation and the macro environment may have implications for pricing decisions in the market, i.e., identifying how that will be accepted by a customer base. It’s important to analyze what competitors are doing and what customers are doing. How are they passing on increasing costs? How has the company’s value proposition evolved? It’s important to look at both the cost side of the equation and the value proposition being delivered.

This scenario of price increases and trying to appease multiple stakeholders highlights an interesting dilemma for Key Account Managers. Almost by definition, these will be large accounts with power in the relationship and will likely hold significant power downstream. The stakes in any move (i.e., pricing, market coverage, innovation access, product exclusivity) will be significant and will require a thoughtful approach.

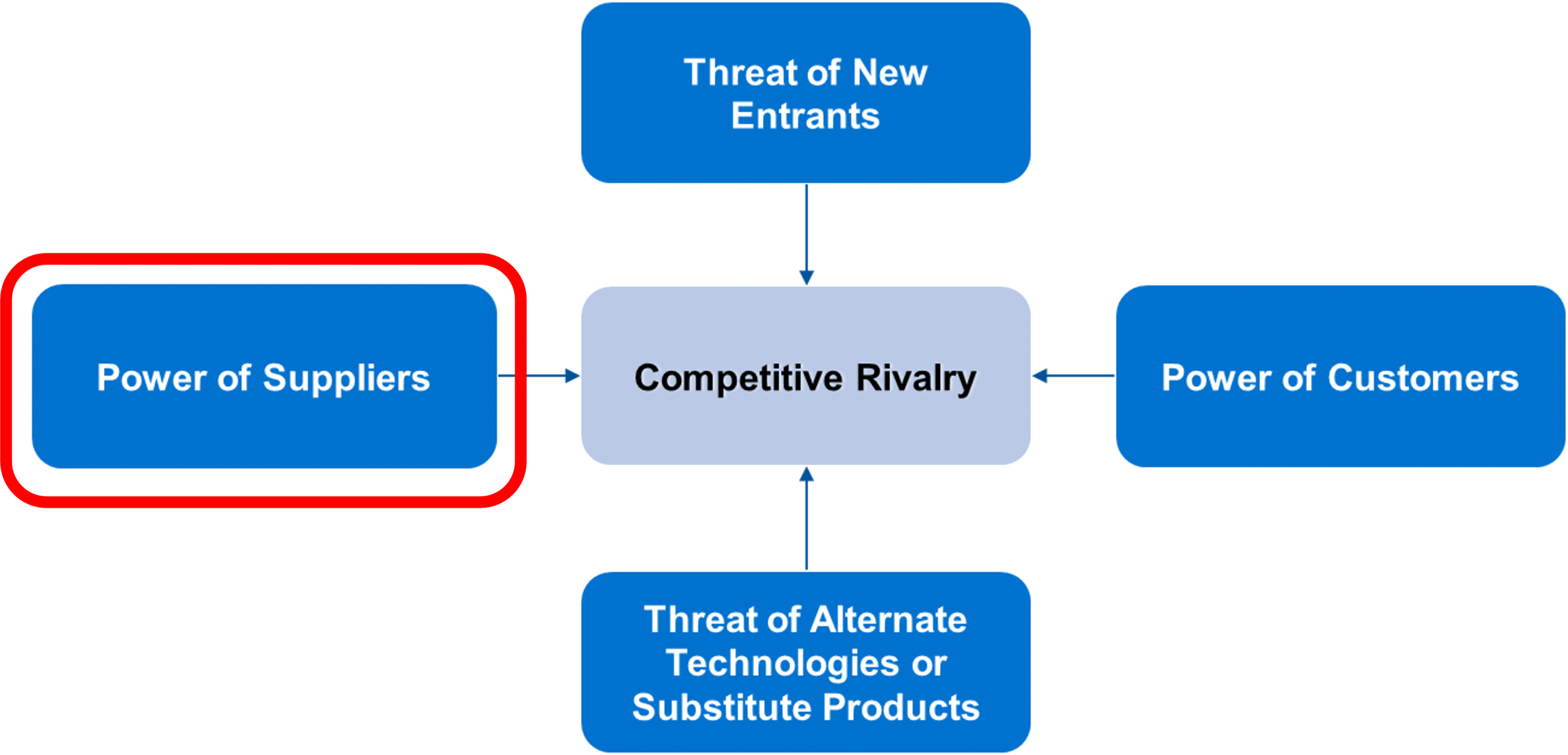

Porter’s Five Forces

Market Edge finds it helpful to leverage learning from Porter’s Five Forces. The analysis provides actionable insight into the forces exerting pressure on pricing and profitability through the value chain.

Example – How can a distributor understand a supplier’s ability to raise prices?

Identify the following:

- Supplier Concentration: Are your suppliers fragmented or highly concentrated? If any industry is dominated by a few supplies, they are typically powerful.

- Threat of Forward Integration: Can the supplier produce the product you make?

- Availability of Substitute Products/Technologies: What is the availability of substitute products or technologies to replace the supplied product? If nothing is available, suppliers are typically more powerful.

- Switching Costs to Change: What is the cost to change to other sources of supply or a substitute product? If switching costs are high, suppliers are typically more powerful.

- Importance of Supplier Product to Performance: Is your supplier’s product essential to the quality or performance of your product? If yes, suppliers are typically more powerful.

By thoughtfully exploring each of these, we should be able to better understand our position and create a common view of the relative risk we have in any supplier/customer relationship. No “one” of these questions will define the power of a supplier, but by taking a holistic approach, it’s possible to assess relative power and use that as a guide in discussions and forward approaches.

Interested in using Porter’s Five Forces analysis for your team? Download the Market Edge 2024 Tools & Frameworks Brochure or visit our Tools webpage.

To get in touch with a consultant, fill out the contact form below.