As earnings season for public companies comes to a close, now is the time to update key account plans.

Start with the account’s performance in 2023. Review their 10K, annual report (no, they are not the same thing!) and most recent press releases. Stay focused on the division(s) or business unit(s) that you serve. Look beyond top line and operating profit to understand cash flow and balance sheet changes.

Strategy & Performance Changes

- How did the account perform versus prior year and versus their key competitors in markets (applications and geographies) where you are the key supplier?

- Are they emphasizing adjacent or new markets as the source of future growth?

- Have changes in their balance sheet affected the value of their working capital or their cost of capital?

Changes in the key account’s strategy or performance are opportunities for suppliers to contribute to the account’s new strategic initiatives or reposition existing offers in alignment with account’s updated financial reality.

Organizational Changes

- Are there changes in C-suite positions?

- Is the account experiencing a “transformation” (i.e., reorganization)?

- Have procurement roles, responsibilities or metrics changed?

If so, update influencer maps and spend analyses. Identify the key messages that new individuals are emphasizing in their presentations and social presence.

Operational Changes

- How has the account’s bill of materials changed (i.e., is the raw material you supply more/less important to the key account’s COGS)?

- Is the account or your competitors changing their sourcing or export flows?

- Has new legislation, regulatory or intellectual property affected the account’s operations?

Accounts that are changing their supply chain strategy can be an opportunity or a threat. Proactively establishing new supply chains to align with your account’s manufacturing footprint maintains a competitive advantage over rivals. If not addressed, it is an opportunity for competitors to gain access to your key account.

Case Example

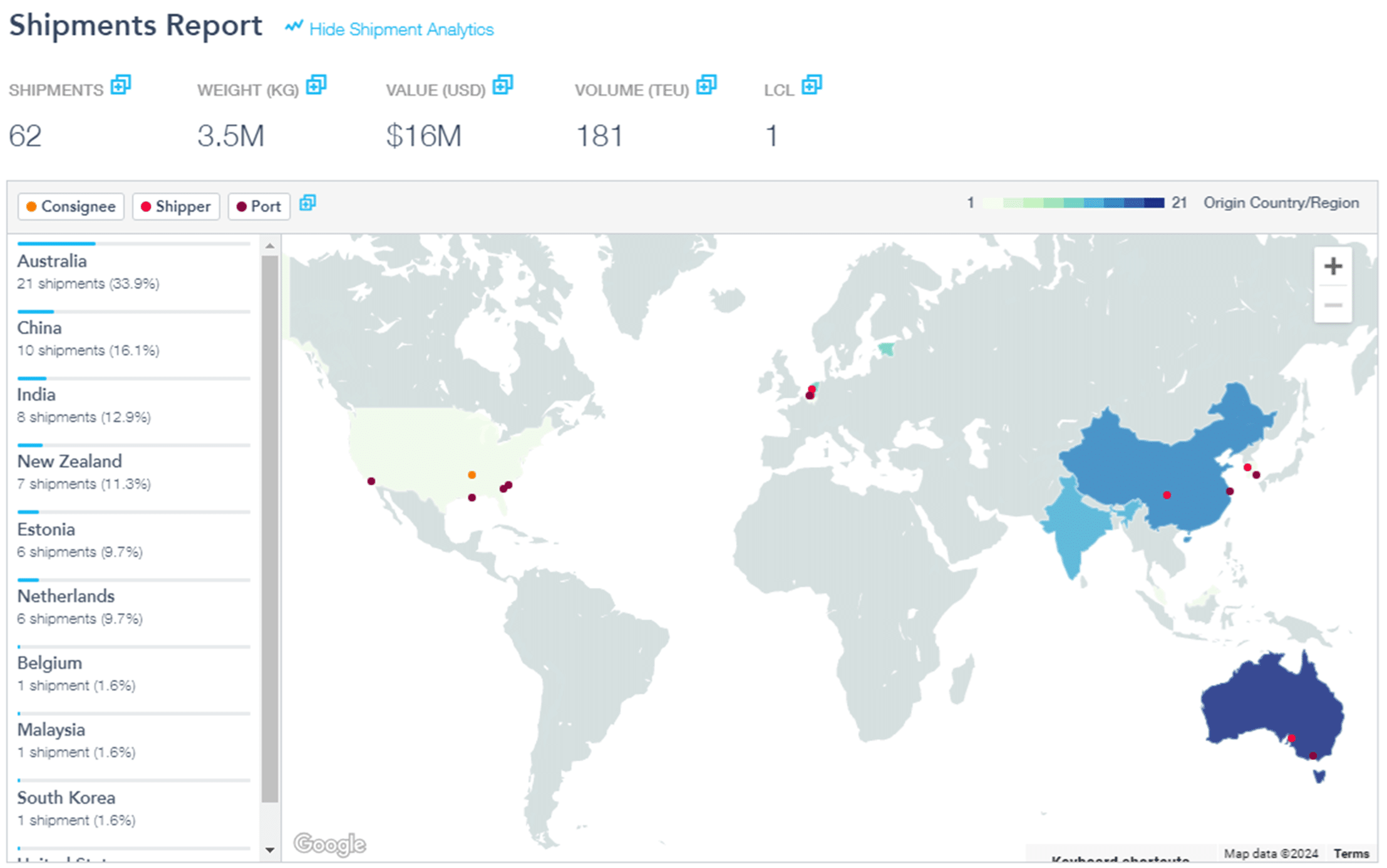

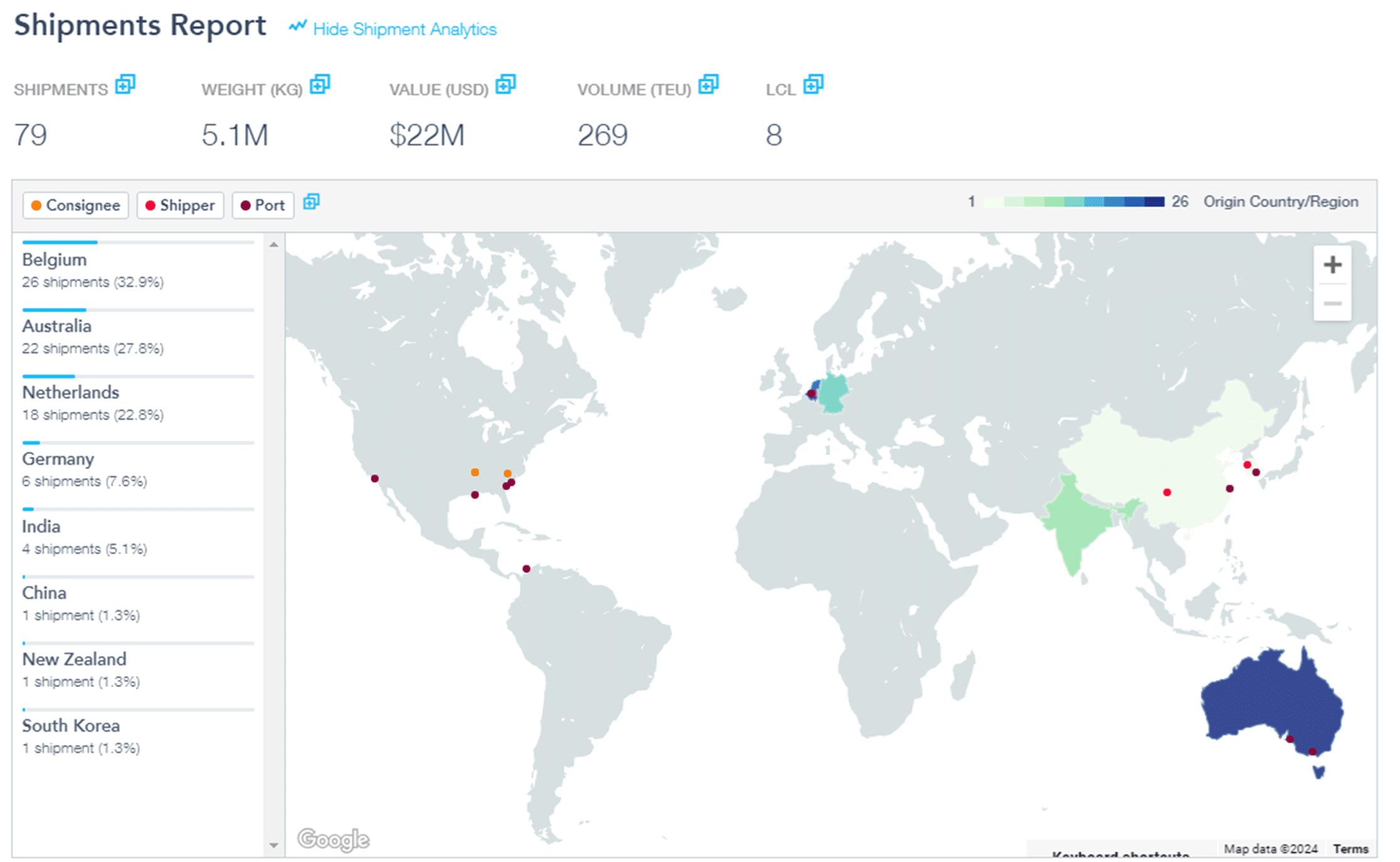

Examine trade flows for significant shifts and implications. In this client example from the building materials sector, the value of a competitor’s purchase of a critical raw material (in the manufacture of pressure treated wood) increased 38% from 2019 to 2023. Belgium moved from being insignificant to the competitor’s largest source of supply.

The Implication

This competitor appears to be moving to the same source of supply as the client company, removing a critical source of cost advantage. To maintain position at key accounts, the supplier will have to develop new sources of differentiation, update value propositions and rework long term supply agreements.

Interested in learning more about building key account management capability or reviewing your current key account plans? Get in contact with a Market Edge consultant by filling out the form below.