Imagine a company has a new desirable technology that the market will pay more for. The offer is so attractive, there is a waitlist of customers. Picture yourself as the marketing manager that is handling this offer and has PEST drivers that support the rapid growth of your new product and technology.

Now imagine that 20% of your leading-edge customers, after using the product, decide that it is too difficult to maintain. What happens when they go back to their previous outdated, lower-tech, and less environmentally-friendly solution?

Congrats, you are now in the same position as the California Electric Vehicle (EV) suppliers whose customers have gone back to gas-fueled vehicles because charging an EV is too difficult.

“While EVs may be the new technological hotness on the automotive market, they come with a caveat: slow charging times. While you can sing the praises of the benefits of EV ownership, many people can’t argue with the differences between charging and filling up an ICE car with gas… Some drivers miss that convenience, as a recent study done by UC Davis (Via Business Insider) shows one in five EV owners switched back to gas after going green. EVs, it seems, were just too much of a hassle.” – Lawrence Hodge at Jalopnik

Where did EV companies go wrong? With 20% turnover in California, EV companies have either clearly misunderstood their customer experience or have not sufficiently addressed pain points (or both). Where could these suppliers have done a better job at understanding customer needs, decision making, activity cycle, offer development, and feedback? How we can learn from this example:

-

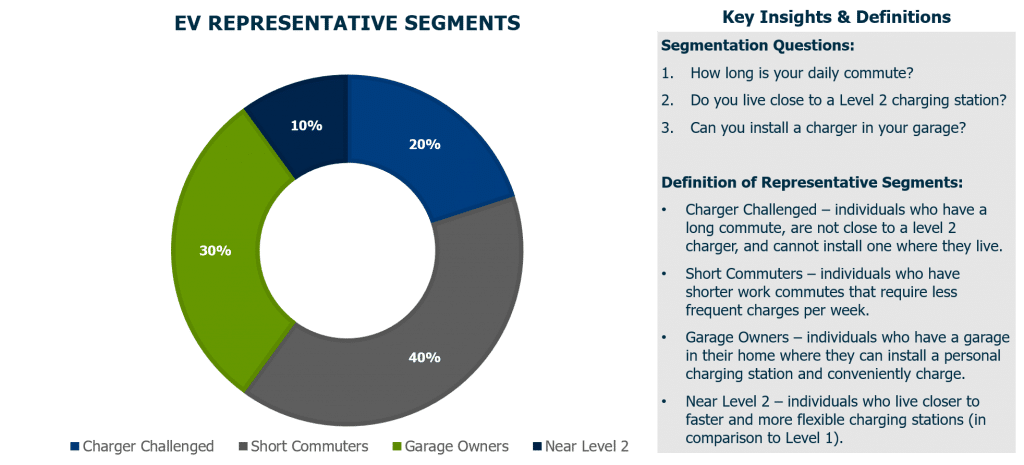

- Segmentation & Targeting – Do we understand the customers that will be best served by our offer? What are the needs-based segmentation and how do we target them? For example, apartment dwellers can’t install a charging station where they live because they may not have access to a garage. What alternative solutions could be used to solve this issue?

- Customer Activity Cycle – Do we understand how our customers will engage with our product? Did EV suppliers consider the charging hassle for new customers?

- Offer Development – Have we developed our offer beyond the physical product with the customer experience in mind? What services are needed in support of your product that needs to be in place for successful and continued use?

- Net Promoter Score and Customer Understanding – Have we quickly assessed issues with our offer and addressed those issues in order to increase customer satisfaction?

- Cost of Acquisition – Do we understand the costs associated with our customer frustrations and the benefits of addressing those frustrations? How much is lost when new customers turn away?

While all of these areas are important for a novel offer, the importance only magnifies for offers that are similar or the same as the competition. In those instances, the cost of a customer’s frustration is a shift to a competitive offer that goes largely unnoticed. ICE and electric vehicles are fairly similar offers overall, and therefore, when charging becomes an inconvenience, there are not many negative tradeoffs to prevent customers from switching back to an ICE vehicle. No great “switching costs” or articles to discuss, simply a lost customer based on a frustration that may not have been recognized.

The need for understanding the customer experience is tantamount. Consider your own offers and the customer experience associated with them. Are you losing customers that prefer your offer compared to the competitors because you’re too difficult for your customers to deal with? Asking these questions will help you get a feel for where you stand with your customers and the experience you are providing for them.

For more information about segmentation, customer activity cycles, and improving customer experience, contact a Market Edge consultant: